Tangible Personal Property

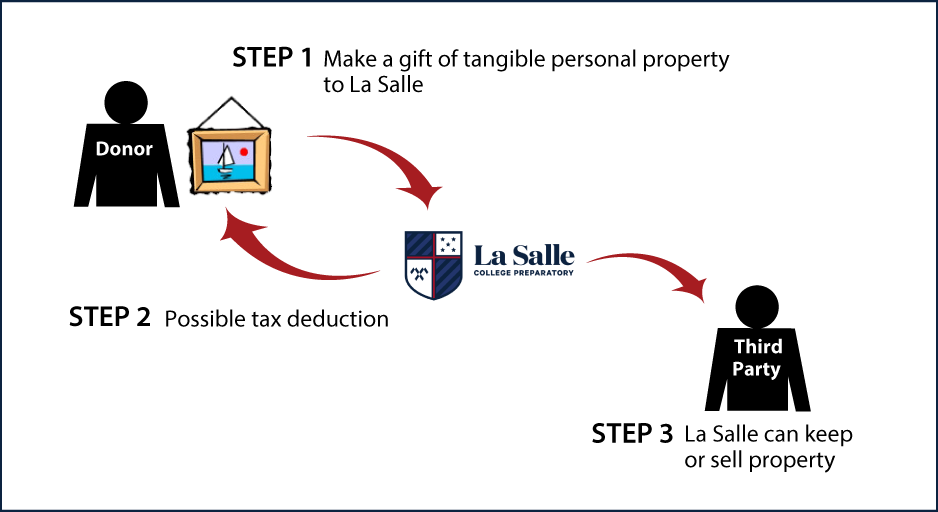

How It Works

- Please call us to discuss the type of tangible property, possible uses of your gift by La Salle, and getting an appraisal

- You receive a charitable income-tax deduction for the full fair-market value of the property if the gift's use is related to La Salle's exempt purposes

- If the use is unrelated to our exempt purposes or if it's understood that we will be selling the property, then the deduction is limited to your cost basis

Benefits

- You receive a federal income-tax deduction for the fair-market value if the gift's use is related to La Salle's charitable purposes

- You avoid capital-gain tax on long-term related-use property (Note: The top capital-gain tax rate on such assets is 28%.)

- You provide significant support for La Salle without affecting your income

Special note: You should call or e-mail us to tell us of your intent with regards to the property, and we will be able to assist you with the details of the transfer.

More Information

Request an eBrochure

Which Gift Is Right for You?

Contact Us

|

MJ Mao |

LaSalle College Preparatory School |

© Pentera, Inc. Planned giving content. All rights reserved.

Disclaimer

DISCOVER LA SALLE

La Salle College Preparatory was founded in 1956. Today, we are the only truly diverse and co-educational Catholic high school in Pasadena.